HOME > Football

The valuation is about $10 billion. Sure enough, the Lakers are the most valuable team in the NBA

2:16am, 20 June 2025【Football】

June 19, recently, big news came from the sports business field: the Bass family is reaching an agreement with TWG Global CEO and Chairman Mark Walter to sell a majority stake in the Los Angeles Lakers. The valuation of this deal is as high as about US$10 billion, which not only breaks the NBA team's trading record, but also confirms the Lakers' position as the most valuable team in the league. Behind this milestone transaction is a concentrated reflection of the Lakers' brand value, global influence and business territory accumulated over the past century.

###1. The business logic of century trading: Why is the Lakers worth 10 billion?

From former Microsoft CEO Ballmer's acquisition of the Clippers for $2 billion in 2014, to Matt Ishbiya's purchase of the Suns for $4 billion in 2023, NBA team valuations have shown exponential growth in the past decade. But the Lakers' deal still shocked the industry - its valuation is 1.3 times that of the second-place Golden State Warriors ($7.5 billion), and 2.6 times the average valuation of the league team ($3.85 billion). This premium comes from three core assets:

First, the Lakers have the largest global fan base in the NBA. According to Nelson Sports data, the total number of Lakers' social media fans reached 120 million, and the proportion of fans in the Chinese market exceeded 28%. Its game broadcast covers 215 countries and regions, and the jersey sponsorship contract alone brings $150 million in revenue each year. Secondly, Staples Center (now renamed Crypto.com Hall) is the most profitable home stadium in the league, with an average annual ticket revenue of over US$180 million, and the luxury private rooms have maintained a occupancy rate of more than 95% all year round. More importantly, the 20-year media copyright agreement signed by the Lakers and Warner Bros. Discovery Group (effective from 2025) is expected to bring an average annual fixed income of $350 million.

TWG Global led by Mark Walter chose to take action at this time, and it was the Lakers' ability to resist the cycle. Even in the 2022-23 season, the Lakers still led the league with revenue of US$470 million, proving the business resilience of the "Purple Gold Dynasty".

###2. The era of the Bass family turns around: From beer tycoon to sports legend

This equity sale marks the entry of the Bass family into a new stage of 46 years of domination over the Lakers. In 1979, the late boss Jerry Bass bought the team for only $67.5 million, and the deal was seen as a gamble—the equivalent of 15 times the annual profit of the family beer business. But "Dr." Bass proved the value of this decision with business genius: he pioneered the introduction of "Showtime" basketball concept, combining superstars such as Magic Johnson and Jabbar with Hollywood entertainment culture, and completely changed the operating model of professional sports. During the reign of the old Bass daughter Jenny Bass (2013 to the present), the Lakers brand value soared from $900 million to 10 billion. The digital transformation she led is particularly critical: the cumulative download volume of official APP launched in 2020 exceeded 30 million times, and the sales of virtual goods increased by 47% per year; the customized content channel cooperated with Tencent brought an average annual revenue of US$60 million to the Chinese market. Although the family retains minority equity, after the transaction is completed, the Lakers will be run by professional investment institutions for the first time, which may indicate that professional sports capitalization has entered a new stage.

###3. The new era of NBA capital game

Lakers trading coincides with the key node of NBA media copyright renegotiation. The alliance's upcoming broadcast contract is expected to launch in 2025, with a total value of more than US$75 billion (currently, the contract is 24 billion). The salary caps of each team have increased, and the annual salary of top stars may exceed $80 million. Under this expectation, the Lakers, as the team with the highest media exposure (43 live broadcasts across the United States last season), naturally became the target of capital pursuit.

It is worth noting that Mark Walter owns part of the MLB Los Angeles Dodgers and Premier League Chelsea, a cross-sports league capital layout hints at a new trend: the super rich are using top sports IP as a hard asset to hedge inflation. Goldman Sachs sports industry analysts pointed out: "When technology stocks volatility intensifies, teams like the Lakers that have stable cash flow and asset appreciation expectations have become more reliable means of storage of value than gold. "

###4. Invisible game of the Chinese market

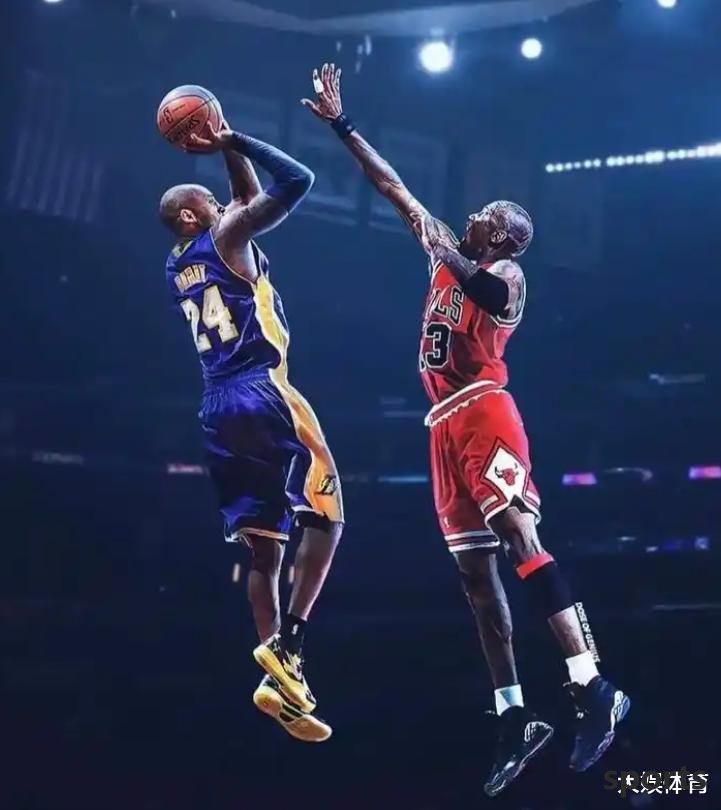

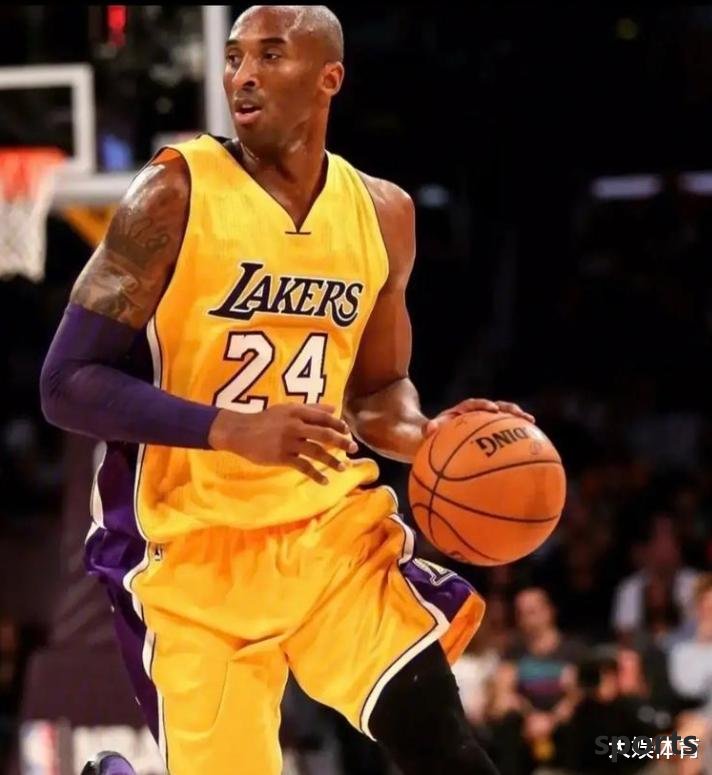

In the Lakers' global territory, the Chinese market has always been a special existence. Kobe's performance at the 2008 Beijing Olympics, "Redification Team" allowed the Lakers to gain 120 million Chinese fans. Currently, the team's official Weibo account has 8.3 million followers, 1.8 times that of the Warriors. According to statistics from Lazy Bear Sports, the annual sales of authorized commodities in Lakers China exceed 200 million yuan, and the series of sneakers jointly released with Li Ning triggered a wave of buying every time it was released. After the transaction is completed, the key challenge faced by the new owner is how to maintain this emotional connection. TWG Global's localization strategy in Chelsea's operations - such as inviting Chinese e-sports players to participate in virtual locker room interactions - may be copied into Lakers' operations. But what Chinese fans are more concerned about is: After James retires, who will be the next Chinese player to be selected by the Lakers? Behind this problem is the multi-billion dollar market expectations.

###5. The double-edged sword of sports capitalization

When a basketball team is worth more than United Airlines (market value of 9.5 billion) or Ford Motor (market value of 9.8 billion), doubts will follow. NBA legend Charles Barkley publicly criticized: "This will completely lose competitiveness in small market teams." Indeed, the new Lakers boss faces not only the team management, but also the eternal proposition of how to balance competition and business.

But it is undeniable that the Bass family and Mark Walter jointly wrote a new chapter in professional sports. From 67.5 million in 1979 to 10 billion in 2025, the 147-fold increase in Lakers' valuation is to some extent a microcosm of the development of the modern sports industry. When the lights of the player passage lights up again, the eternal abbreviation - Lakers will still be reflected on the floor in the center of Staples. However, in the future, this word will not only represent basketball legends, but also symbolize the pinnacle of global sports capitalization.

7M CN VNRelated Posts

- Zhan Jun: Sobo should be the most stable core for the Red Army in the new season. The most important thing is to improve the defense.

- 0-1, the former Premier League champion lost to Millwall and suffered 2 consecutive defeats in the English Championship + dropped to 10th place

- One-day Premier League news: Manchester United is accelerating the sale of backup shooters, Slott has a new target to buy defenders

- 22 seats have been reserved for the World Cup: Cape Verde, a small country with a population of 540,000, has advanced! There are 3 seats left in the African region.

- Defeat! Ruben Neves: Jota’s jersey gives me extra strength and the victory is well deserved

- Damn laughing: 1-0 in 90 minutes, Guardiola excitedly kissed the fourth official, and Manchester City was beaten 3 minutes later

- Infantino: Serie A is the league in my life, I will always pay attention to A

- 2025.08.31 Paris Football Club VS Metz Event Recommendation Analysis

- Austrian roster: Alaba leads, Sabize, Lemel, Anau, and Dansor are selected

- Real Madrid double stars Mbappe and Vinicius are in a crisis of self-confidence

Hot Posts

- Zhan Jun: Sobo should be the most stable core for the Red Army in the new season. The most important thing is to improve the defense.

- 0-1, the former Premier League champion lost to Millwall and suffered 2 consecutive defeats in the English Championship + dropped to 10th place

- One-day Premier League news: Manchester United is accelerating the sale of backup shooters, Slott has a new target to buy defenders

- 22 seats have been reserved for the World Cup: Cape Verde, a small country with a population of 540,000, has advanced! There are 3 seats left in the African region.

Recommend

Enrique: The team s sense of football is still lacking, which is more important than the player s physical fitness.

Europa League: 2-0, Premier League 16th overturned the Nov. 1st, embracing 2 consecutive victories, 42 Van Persie leads the team to lose 2 consecutive losses

God helps Inter Milan! 2-2 big upsets, Inter Milan won four consecutive victories in the championship, only 1 point ahead of Inter Milan

Romano: Naples negotiates the transfer of Turin goalkeeper Vania today, with a quotation of 18 million euros

Levi takes action? Mirror: Tottenham will give Frank a large transfer budget, targeting Mbemo & Semeno

Bombshell! 20-year-old talented defender joins Real Madrid at a sky-high price! The new football pattern behind the 50 million pound deal

Comparing with Dewey! It is expected to be the first in team history! US media: Who do you choose the strongest MVP of the Thunder?

Deutsche transfer official: Deutsche Paul s value in MLS is reduced by 5 million, Son Heung-min s value remains unchanged due to his commercial value